Get the job you really want.

Maximum of 25 job preferences reached.

Top Tax Jobs in Melbourne

Cloud • Fintech • Information Technology • Machine Learning • Software

Own New Zealand tax compliance (including fringe benefits and income tax), prepare month-end tax effect accounting, support financial reporting, advise on international tax issues, and improve processes using AI tools while collaborating with global teams.

Top Skills:

Gemini,Glean

Information Technology

The Indirect Tax Specialist drives market growth for the Indirect Tax Portfolio in ANZ by managing compliance challenges, generating new business, and strengthening product positioning.

Top Skills:

ComplianceMarketingSalesTechnology

Information Technology • Legal Tech

As an Associate/Senior Associate in Tax, you will advise clients on tax issues, handle disputes, and collaborate with partners across various sectors.

Fintech • Professional Services • Software • Financial Services

Join the Innovation Incentives team as a graduate to support clients with R&D application preparation, calculate R&D expenditure, assist audits/reviews, draft client advice, engage in business development, and learn about emerging industries while working closely with partners and specialists.

Fintech • Software • Financial Services

Provide corporate and international tax advisory and compliance services to medium and large clients, working with partners on complex tax matters, performing research, analysis, and client-facing work within a collaborative team.

Fintech • Payments • Financial Services

Manage corporate income tax, GST and FBT obligations for Australian and NZ entities; prepare tax returns and tax-effect accounting, maintain franking accounts and statutory registers, monitor legislative changes, and improve tax reporting systems, controls and disclosures.

Top Skills:

Onesource Corporate Tax

New

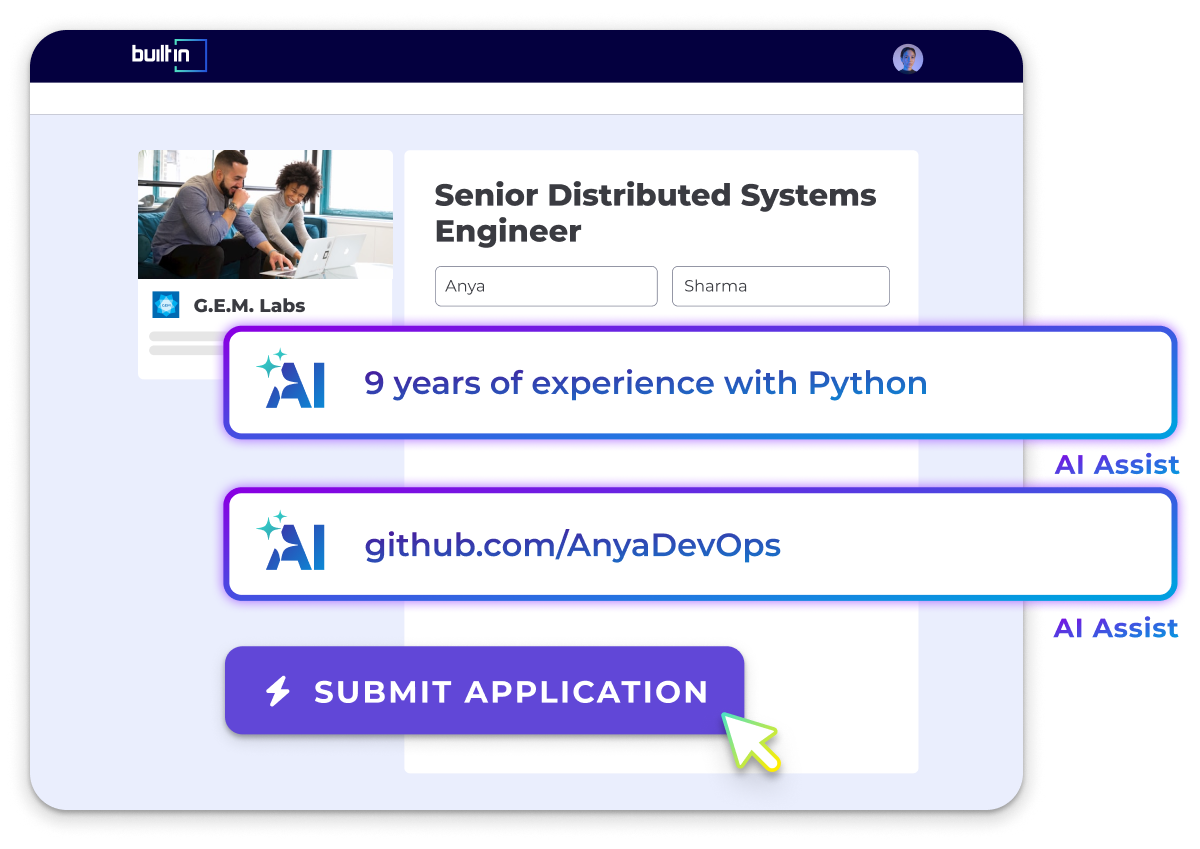

Cut your apply time in half.

Use ourAI Assistantto automatically fill your job applications.

Use For Free

Professional Services • Consulting

Prepare corporate income tax returns, research tax issues, draft technical advice, prepare tax effect accounting work papers, deliver in-house tax training, and support advanced tax matters (consolidation, structuring, transfer pricing) for a diverse client base.

Fintech • Professional Services • Software • Financial Services

The Corporate Tax Senior Manager will oversee client engagements in tax compliance and advisory, manage client relationships, and lead a team, fostering growth and development while ensuring high standards of technical expertise.

Top Skills:

AccountingBusiness DevelopmentTax AdvisoryTax Compliance

Consulting

Lead and manage tax compliance, strategy and risk across ANZ. Advise on restructures, transfer pricing, CFC and Pillar Two implementation, oversee R&D claims, audits, ERP/SAP tax migration, and prepare tax accounting and disclosures.

Top Skills:

ExcelMS OfficeSAP

Fintech • Professional Services • Software • Financial Services

As a Corporate Tax Manager, you will lead the tax team, manage client relationships, provide technical tax advice, and oversee compliance for large client groups. You will also support coaching and business development activities.

Top Skills:

AccountingFinanceTax Advisory

Fintech • Software • Financial Services

Prepare monthly and quarterly BAS; complete PAYG instalment calculations and lodgements; assist with tax returns (including trusts); perform quarterly FBT reviews and returns; lodge Certificates of Tax Residency; support salary packaging and novated leases; advise stakeholders on tax matters and perform ad-hoc compliance duties.

Top Skills:

ExcelMS OfficeOnesourcePower QueryWorkday

Fintech • Professional Services • Software • Financial Services

The Corporate Tax Senior Associate will provide corporate tax compliance and advisory services, assist clients with M&A activities, and conduct research on technical tax issues.

Let Your Resume Do The Work

Upload your resume to be matched with jobs you're a great fit for.

Success! We'll use this to further personalize your experience.

Top Melbourne Companies Hiring Tax Roles

See AllPopular Job Searches

Tech Jobs & Startup Jobs in Melbourne

Remote Jobs in Melbourne

Account Executive Jobs in Melbourne

Account Manager Jobs in Melbourne

Accounting Jobs in Melbourne

AI Jobs in Melbourne

Analyst Jobs in Melbourne

Android Developer Jobs in Melbourne

Application Support Jobs in Melbourne

AWS Jobs in Melbourne

Azure Jobs in Melbourne

Blockchain Jobs in Melbourne

Business Analyst Jobs in Melbourne

Business Development Jobs in Melbourne

Business Development Manager Jobs in Melbourne

Cloud Engineer Jobs in Melbourne

Content Jobs in Melbourne

Customer Service Jobs in Melbourne

Customer Support Jobs in Melbourne

Cyber Security Jobs in Melbourne

Data Analyst Jobs in Melbourne

Data Analytics Jobs in Melbourne

Data Engineer Jobs in Melbourne

Data Science Jobs in Melbourne

Database Administrator Jobs in Melbourne

Design Jobs in Melbourne

DevOps Jobs in Melbourne

Engineering Jobs in Melbourne

Engineering Manager Jobs in Melbourne

Finance Jobs in Melbourne

Finance Manager Jobs in Melbourne

Financial Analyst Jobs in Melbourne

Front End Developer Jobs in Melbourne

Full Stack Developer Jobs in Melbourne

Graphic Design Jobs in Melbourne

HR Jobs in Melbourne

Intelligence Analyst Jobs in Melbourne

iOS Developer Jobs in Melbourne

IT Jobs in Melbourne

IT Support Jobs in Melbourne

Java Developer Jobs in Melbourne

Legal Jobs in Melbourne

Linux Jobs in Melbourne

Machine Learning Jobs in Melbourne

Marketing Jobs in Melbourne

Marketing Manager Jobs in Melbourne

NET Jobs in Melbourne

Network Engineer Jobs in Melbourne

Operations Jobs in Melbourne

Product Design Jobs in Melbourne

Product Manager Jobs in Melbourne

Product Owner Jobs in Melbourne

Program Manager Jobs in Melbourne

Project Engineer Jobs in Melbourne

Project Manager Jobs in Melbourne

Python Developer Jobs in Melbourne

Quality Assurance Jobs in Melbourne

Quality Engineer Jobs in Melbourne

React Developer Jobs in Melbourne

Sales Consultant Jobs in Melbourne

Sales Engineer Jobs in Melbourne

Sales Executive Jobs in Melbourne

Sales Jobs in Melbourne

Sales Manager Jobs in Melbourne

Sales Rep Jobs in Melbourne

Salesforce Developer Jobs in Melbourne

Scrum Master Jobs in Melbourne

SEO Jobs in Melbourne

Social Media Jobs in Melbourne

Software Engineer Jobs in Melbourne

Software Testing Jobs in Melbourne

Solution Architect Jobs in Melbourne

Systems Engineer Jobs in Melbourne

Talent Acquisition Jobs in Melbourne

Tax Jobs in Melbourne

UX Designer Jobs in Melbourne

UX Jobs in Melbourne

Web Developer Jobs in Melbourne

Writing Jobs in Melbourne

All Filters

Total selected ()

No Results

No Results